how to file 1095 b electronically

And one of the most important things when e-filing is finding. Form 1095-B and Health Coverage Information Beginning January 31 2018 Horizon Blue Cross Blue Shield of New Jersey will mail Form 1095-B to your employees who are enrolled in Horizon BCBSNJ coverage through your employer-sponsored health plan.

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

Simple steps to file 1095 electronically Employer Details.

. Select the Tax Year to begin filing. 3 Review your Form 1099-B 1096. Directions for filing can be found at the IRS website.

Form 1095-B provides information about your health coverage. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. The 1095-B form is sent to individuals who had health insurance coverage for themselves andor their family members that is not reported on Form 1095-A or 1095-C.

Import your Data Securely using Excel or CSV file format. 1 Enter Federal Tax Withheld Details. E-filing or electronic filing is an online method for filing 1095-B Form.

E-file ACA Form 1095-B Now If you choose to paper file ACA Form 1095-B download the ACA Form 1095-B fill in the necessary details and then send it to the IRS by the address mentioned here. The IRS even recommends you e-file and they also require you to if you have more than 250 forms to file. Easy to get started.

Change the Transmission Type from Original to Correction 1095-C Records or Correction 1095-B Records. If a provider has more than 250 individuals then they are required to file electronically. Form 1095-B is used by the IRS to determine if an individual is eligible for premium tax credit.

1095-A is the only 1095 form that needs to be entered into TurboTax. Turbotax does not understand that the Tax form 1095-B is a full coverage document provided by TRICARE as proof of insurance for military and government. We can help eliminate the stress of filing information returns by providing complete secure outsourcing solutions.

TurboTax will ask questions about your medical coverage and you will answer that you have insurance for the full year. With our ACA Core we completely take care of your ACA 1094 1095 Form generation and e-file them with the IRS on your behalf. E-filing or electronic filing is an online method for filing 1095-B Form.

Ad Download or Email IRS 1095-B More Fillable Forms Register and Subscribe Now. To e-file Form 1095-B with TaxBandits follow the steps below Create an account or log in to your existing account. Ad Edit Sign or Email IRS 1095-B More Fillable Forms Register and Subscribe Now.

For example any person who provides minimum essential healthcare coverage to an individual must file an information return reporting the. Information about Form 1095-B Health Coverage including recent updates related forms and instructions on how to file. Smaller self-insured employers who must fill out the 1095-B and 1094-B transmittal form use efileACAforms to report the names addresses and.

Add the employerinsurer information and Click Save and Continue. If you choose to paper file ACA Form 1095-B download the ACA Form 1095-B fill in the necessary details and then send it to the IRS by the address mentioned here. CMS-1500 should be submitted with the appropriate resubmission code value of 7 in Box 22 of the paper.

It is for reporting information to the IRS and to taxpayers about individuals not covered by the minimum essential healthcare coverage. Forms 1094-B and 1095-B must be filed with the IRS on or before February 28 of the year following the year the coverage is provided March 31 if filed electronically. E-file ACA Form 1095-B Now.

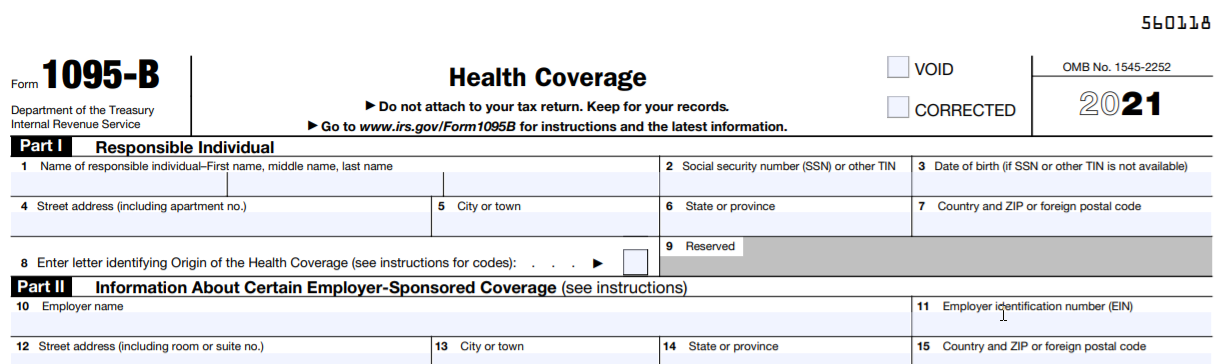

Part I identifies the policyholder for the insurance policy. In the top left corner you will see this. E-file 1095 Forms directly to the IRS and States.

4 Transmit your Form 1099-B to the IRS. ACAwise will perform data validations to prevent errors. Ad Our Easy-to-Use Software Helps You Prepare and E-File Your Tax Return.

E-filing allows for faster more secure filing right from your own computer. Employers who provide health coverage known as self-insured coverage but are not required to send form 1095-C to the individual. File 1099-B Online with Tax1099 for easy and secure e-File 1099-B form 2021.

Form 1094-B is a summary form that is filed with form 1095-B electronically or on paper. Choose an Electronic filing method for quick secure and accurate filing. Click on File Information Returns Electronically and a box will pop up.

How to file 1099-B instructions due date. Deadline for paper filing is February 28 2017 for reporting information on the 2016 calendar year An automatic 30-day extension of time to file is. E-filing Form 1095-B.

Create the data and manifest file. You can review Forms and notify for any corrections. For an employer-sponsored plan for example this would be the name of the employee.

Applicable large employers with 50 or more full-time or full-time-equivalent employees use efileACAforms to save on the labor costs of preparing printing mailing and manually submitting their 1095-C and 1094-C forms to the IRS. Let our trained staff import your data from excel print and mail if necessary and electronically file on your behalf. Office of Personnel Management.

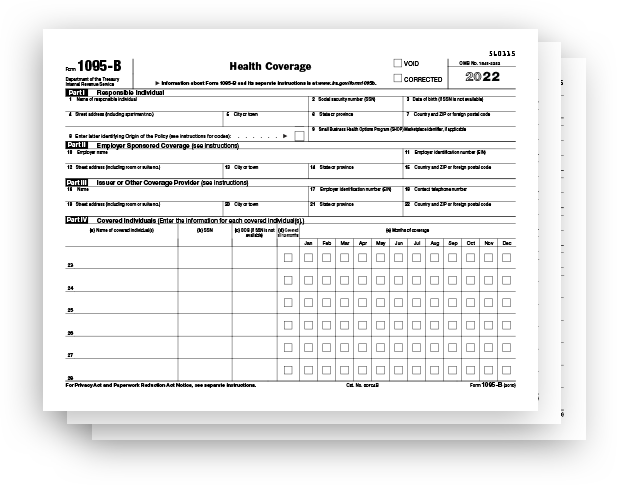

The form has four parts. Under the NJ Electronic Filing Mandate preparers that reasonably expect to prepare 11 or more individual gross income tax resident returns including those filed for trusts and estates during the tax year must use electronic methods to file those. Click on Start Filing under the Form 1094-B and 1095-B sections.

1900 E Street NW Washington DC 20415. Just save the 1095-B with your 2020 tax records. Both paper and electronic claims must be submitted within 365 calendar days from the initial date of service.

We can electronically file prior year 1095-B or 1095-C forms using our TCC number. IRS Form 1095-B This form is part of the Affordable Care Act. The following instructions explain how to bill and submit a corrected claim.

See Statements Furnished to Individuals later for information on when Form 1095-B. ACAwise will generate 1094 and 1095 Forms with codes. Penalty amounts are based on the size of.

Choose the preferred method bulkManual to add Form. It is your proof that you had medical insurance coverage. The ANSWER provided as such is not an answer at all but instead an evasive subtext simply placed here to check a box somewhere showing that it has been addressed when in fact it has not.

The 1095-B form provides information about your. Electronically-filed 1099-B forms are directly transmitted to the IRS from Tax1099. 2 Enter State Tax Withheld Details.

2 Enter State Tax Withheld Details. 1095-B is for your records only. How to E-File with Free Support Helpful Software Guaranteed Calculation Accuracy.

How do I electronically file Forms 1094-C and 1095-C with the Internal Revenue Service IRS. If you have missed the ACA Form 1095-B filing deadline failed to file with the proper information or filed your form on paper when you were required to file it electronically you may be penalized by the IRS. Form 1095-B is used by providers of minimum essential health coverage to file returns reporting information.

For forms filed in 2022 reporting coverage provided in calendar year 2021 Forms 1094-B and 1095-B are required to be filed by February 28 2022 or March 31 2022 if filing electronically. 4 Transmit your Form 1099-B to the IRS. IRS requires e-filing of Form 1095-B 1095-C if the total number of filings were more than 250 returns.

Part II identifies the employer if the insurance is employer-sponsored.

What Is Form 1095 B Filing Methods 2020 Due Dates Mailing Address

Affordable Care Act Form 1095 B Form And Software 100 Pk Hrdirect

Aca Form 1095 B Filing Instructions For Health Coverage Providers

1099 B User Interface Proceeds From Broker And Barter Exchange Transactions Data Is Entered Onto Windows That Resemble The Actual Irs Irs Forms Accounting

1094 B 1095 B Software 599 1095 B Software

Form 1098 C Contributions Of Motor Vehicles Boats And Airplanes A Donee Organization Must File A Separate Form 1098 C Contributio Irs Irs Forms Tax Forms

1099 Div Software To Create Print And E File Irs Form 1099 Div For 2020 Tax Forms 1099 Tax Form Irs Forms

1099 Misc User Interface Miscellaneous Income Data Is Entered Onto Windows That Resemble The Actual Forms Imports Rec Irs Forms Ways To Get Money W2 Forms

Transmitter Information Transmitters Of Information Returns 1098 1099 3921 3922 5498 W 2g Must Complete The Transmi Tax Software Irs Credit Card Hacks

Irs E Filing Deadline March 31 2022 Aca Gps

Healthcare Form 1095 B Clarity Software Solutions

How To Efile Prior Year 1095 B 1095 C Data Air

5498 User Interface Ira Contribution Information Data Is Entered Onto Windows That Resemble The Actual Forms Imports Irs Forms Ways To Get Money W2 Forms

1094 B 1095 B Software 599 1095 B Software

B1095b05 Form 1095 B Health Coverage Greatland Com

1099 Nec Software To Create Print And E File Irs Form 1099 Nec Banking App Credit Card Hacks Irs

All About Form 1095 B H R Block

California Aca Reporting Requirements Health Care Coverage Health Insurance Coverage Rhode Island

What Is Form 1095 B Filing Methods 2020 Due Dates Mailing Address